What Is Utilization Credit Card : Best Credit Cards Reddit 2020 | Top Card Offers | My Millennial Guide

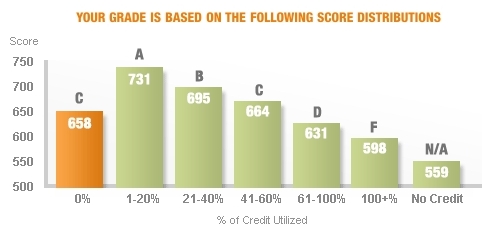

The number you see is your credit utilization. Multiply the result 0.3 by 100 to get 30%. Because credit utilization rates are a reflection of how you use revolving credit, you could take out a personal loan, pay off your credit cards and effectively move the debt to an installment loan (potentially with a lower interest rate than your credit cards). credit card utilization, or ccu, isn't a term that gets a lot of attention compared to concepts such as credit scores and credit reports. Having a lower percentage or ratio is always better for your credit report and in turn, your credit score. A survey conducted by the federal reserve in 2019 revealed that 86% of respondents owned at least one credit card. Please review our list of best credit cards, or. Multiply the result by 100. That 80 percent ratio can drag your credit score down, even though the ratios on the other two cards are good. You should actually keep it at 0% but actually use 100% of your credit. Multiply the result 0.3 by 100 to get 30%. As you'll see below, there is a wide range in credit card limits because consumers with low credit scores can't access high. utilization has been a powerful. The number is calculated by dividing your balance by your credit limit. Multiply by 100 to get your credit card utilization percentage. credit card utilization, or ccu, isn't a term that gets a lot of attention compared to concepts such as credit scores and credit reports. The rate of credit card ownership decreases by age bracket: However, some of our partner offers may have expired. Buying bitcoin can use up your available credit, potentially lowering your credit score. On that third credit card, you have a high utilization ratio of 80 percent. An employee's utilization rate is a critical metric for organizations to track. A high credit utilization in either category can hurt your credit score However, for all groups the average utilization rate declined substantially in the early months of the pandemic. credit scores are empirically built, and variables are only included in models if their predictive value has been validated. Your overall credit utilization ratio will be used to help determine how healthy your current credit card accounts are — essentially how much debt you've used up already on your cards, and how large a balance you carry over each month. If you have one credit card with a credit limit of $500 and you use that credit card to buy something for $100, your current credit utilization ratio would be 20%. If you had the same 5 credit cards, and you had a $1000 balance on each card, your overall rate would be 10%, and the rate on each card would also be 10%. If you've been carrying that balance, i wouldn't worry about "ideal" The total balance is $5,200, and your overall credit limit is. This is one of the quickest and easiest ways to lower your credit utilization ratio. On the third credit card, you owe $8,000 against a limit of $10,000. Another option is getting a balance transfer credit card to transfer balances to a new credit card with a higher credit limit. The calculation looks like this: credit utilization is a snapshot, based on what your creditors report to credit bureaus. You should actually keep it at 0% but actually use 100% of your credit. The average credit card limit. While there is no magic number for the ideal credit utilization ratio, financial experts generally recommend that you keep the rate no higher than 30 percent. You calculate your credit utilization ratio on a single card by dividing your current balance by your credit limit and multiplying it by 100. Multiply the result by 100. A low credit card utilization rate shows that you're using revolving credit but not necessarily relying on it to get by. On the third credit card, you owe $8,000 against a limit of $10,000. That 80 percent ratio can drag your credit score down, even though the ratios on the other two cards are good. Your credit utilization ratio measures the percentage of your total credit card limits you are currently using. Your credit utilization is simply the portion of your available credit you use, expressed as a percentage. First, it scores the credit utilization for each of your credit cards separately. utilization until you get it paid off. The credit utilization ratio is applied to the total of all of your credit card debt, and is not specific to any individual credit card. credit scores are empirically built, and variables are only included in models if their predictive value has been validated. You calculate your credit utilization ratio on a single card by dividing your current balance by your credit limit and multiplying it by 100. Category of your fico credit score. It's so important that it is a key factor in the "debt" However, some of our partner offers may have expired. Call your credit card issuer and ask for a credit limit increase. what is a credit card utilization rate? What Is Utilization Credit Card : Best Credit Cards Reddit 2020 | Top Card Offers | My Millennial Guide. However, some of our partner offers may have expired. utilization has been a powerful. credit utilization is the ratio of your credit card's limit to your current balance. Keeping your credit card utilization ratio under 30% is a good target. It's a measure of billing efficiency that helps the company understand if it's billing enough to cover its cost plus overhead.

credit card utilization is the relationship between the balances on your credit cards and the credit limits on all of your open credit card accounts.

Call your credit card issuer and ask for a credit limit increase.

That's relatively unchanged from december 2015, when the average credit card limit was $8,042.

0 Comments:

Post a Comment